nj tax sale certificate redemption

So if purchasers do not receive what they paid to purchase the New Jersey tax lien certificate plus interest andor penalties within the law mandated redemption period the purchaser acquires title to the property free and clear of all liens created prior to the sale. Please Include the following.

The property owner continues to have the right to redeem the tax sale certificate up until date of the final judgment.

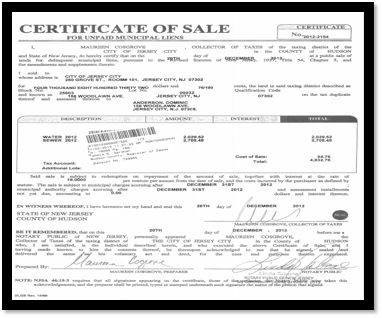

. In addition New Jersey tax lien certificates are secured by real estate. New Jersey Tax Deed Sales New Jersey does have tax deed sales. New Jersey 08210-5000 Tax Sale Certificate Redemption Purpose The purpose is to discharge an original Tax Sale Certificate.

If the Township gets the lien they are allowed to begin to foreclose after only six months. Summary of Middlesex County New Jersey Tax Foreclosure Laws. Request for Certification of Redemption.

It is on this 4th day of February 2022 ORDERED and ADJUDGED that the amount required to redeem the premises from the sale is as follows. Here is a summary of information for tax sales in New Jersey. If the certificate is not redeemed within two years from the date of the tax sale the certificate holder can file an in personam foreclosure action to bar the right of redemption.

The fill in cover sheet form is available at this link. The property owner has a limited amount of time to pay or redeem the tax sale certificate. Elements of Tax Sales in New Jersey.

This is acquired by the foreclosure process. The property owner has the right to redeem the property by paying the taxes along with penalties and interest due. To redeem the lien you must pay all subsequent payments interest and penalties due.

While the following information is accurate it is not meant to be a comprehensive explanation of title 54 of the new jersey statutes which is the law. But if at the sale a person offers a rate of interest less than 1 or at no interest that person may instead of an interest rate offer a premium over the tax amount due including. The property owner did not redeem the certificate and after two years the purchaser initiated a tax lien foreclosure action.

If the certificate is not redeemed within two years from the date of the tax sale the certificate holder can file an in personam foreclosure action to bar the right of redemption. Requirements NJSA 4626A NJSA 545 1. Normally it takes at least two years for a tax lien to be redeemed but with vacant properties they can have tax sale certificates foreclosed in as little as 6 months under the New Jersey Tax Sale law and if a municipality owns the lien it can also be foreclosed on in 6 months.

Interest Rate 18 or more depending on penalties. I would like to have a certificate of redemption prepared for the following property known as. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is.

New Jersey is a good state for tax lien certificate sales. If the tax lien certificate is redeemed by the delinquent property owner prior to foreclosure the tax lien certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the original tax lien certificate in addition to any interest rate on the certificate. Tax Sale Certificate Redemption Redemption.

If the certificate is redeemed after a foreclosure action has been commenced the property owner should file an Affidavit of Redemption and the foreclosure action will be dismissed by entry of an Order. What is sold is a tax sale certificate a lien on the property. A certificate of redemption is an official acknowledgment that a property owner has paid off in full all delinquent property taxes penalties fees and.

Again in a New Jersey tax sale the property is sold at a public auction subject to the right of redemption to the person who offers the lowest interest rate on the tax debt which cant exceed 18. According to new jersey law on tax lien. A lienholder may begin to foreclose on the property two years after the purchase of the tax sale certificate.

Redemption Period 2 years New Jersey Tax Lien Auctions Dates of sales vary depending on the municipality. 120448 is 9550339 which includes taxes interest and stat-utory expenses together with interest on said sums from November 19 2021 together with costs of this suit at 68350. 3515 Bargaintown Road Egg Harbor Township NJ 08234.

Tax sale certificates can earn interest of up to 18 per cent depending on the winning percentage bid at the. A cover sheet or electronic synopsis. If redemption is made after the filing of the complaint redemption is made as to the subject parcel only presuming that notice was filed in the tax collectors office and is subject to the fixing of fees and costs.

Foreclosure The lienholder can begin to foreclose on the property two years after the purchase of the tax sale certificate and they may be entitled to legal fees. Name of the tax. In distressed cities the municipality often ends up holding a large number of tax sale certificates on properties particularly abandoned properties or properties in areas where little or no market exists.

Redemption is made at the office of the tax collector unless otherwise directed. Redemption is governed by statute Only certain enumerated persons with interests in a property may redeem the Tax Sale Certificate. The sale of a tax lien on a property does not give the purchaser of the certificate any rights of ownership or to trespass on the property.

Office of the Tax Collector. 609-492-1109 taxofficebeachhaven-njgov Tax Sale Certificate Redemption Request Form FIGURES MAY CHANGE WITHOUT NOTICE PAYMENT OF LIENS MUST BE BY CERTIFIED FUNDS OR CASH EMAIL OR FAX TO EMAIL ADDRESS OR FAX NUMBER ABOVE THERE IS A 3-DAY TURN. A tax foreclosure sale is subject to redemption.

They include the owners trustees for the owners heirs of the owners holder of any prior tax sale certificates mortgagees and any legal occupant. The issuance of the tax sale certificate set the amount the property owner could pay to redeem the certificate and under New Jersey tax law this redemption amount accrued interest at a rate of 18 percent. The certificate earns a redemption penalty at the rate of 2 4 or 6 percent depending on the amount of the original tax sale.

The municipality will issue a tax sale certificate to the purchaser who then must pay the real estate taxes for a minimum of 2 consecutive years as a condition precedent to filing suit to foreclose the lien. Beach Haven NJ 08008 Phone.

How To Buy Tax Liens In New Jersey

Nj Judge Says Parties With Rights Of First Refusal May Redeem Tax Sale Certificates Walsh

What Are Tax Lien Certificates How Do They Work Clean Slate Tax

Otc Tax Liens How We Made 6 In Less Than 120 Days With Tax Liens